Bill C-19 received royal assent on Thursday after an unusually quick progression through Parliament.

Legislation implementing the Liberal government’s expanded GST rebate for low-income Canadians is now law.

Bill C-19 received royal assent on Thursday after an unusually quick progression through Parliament.

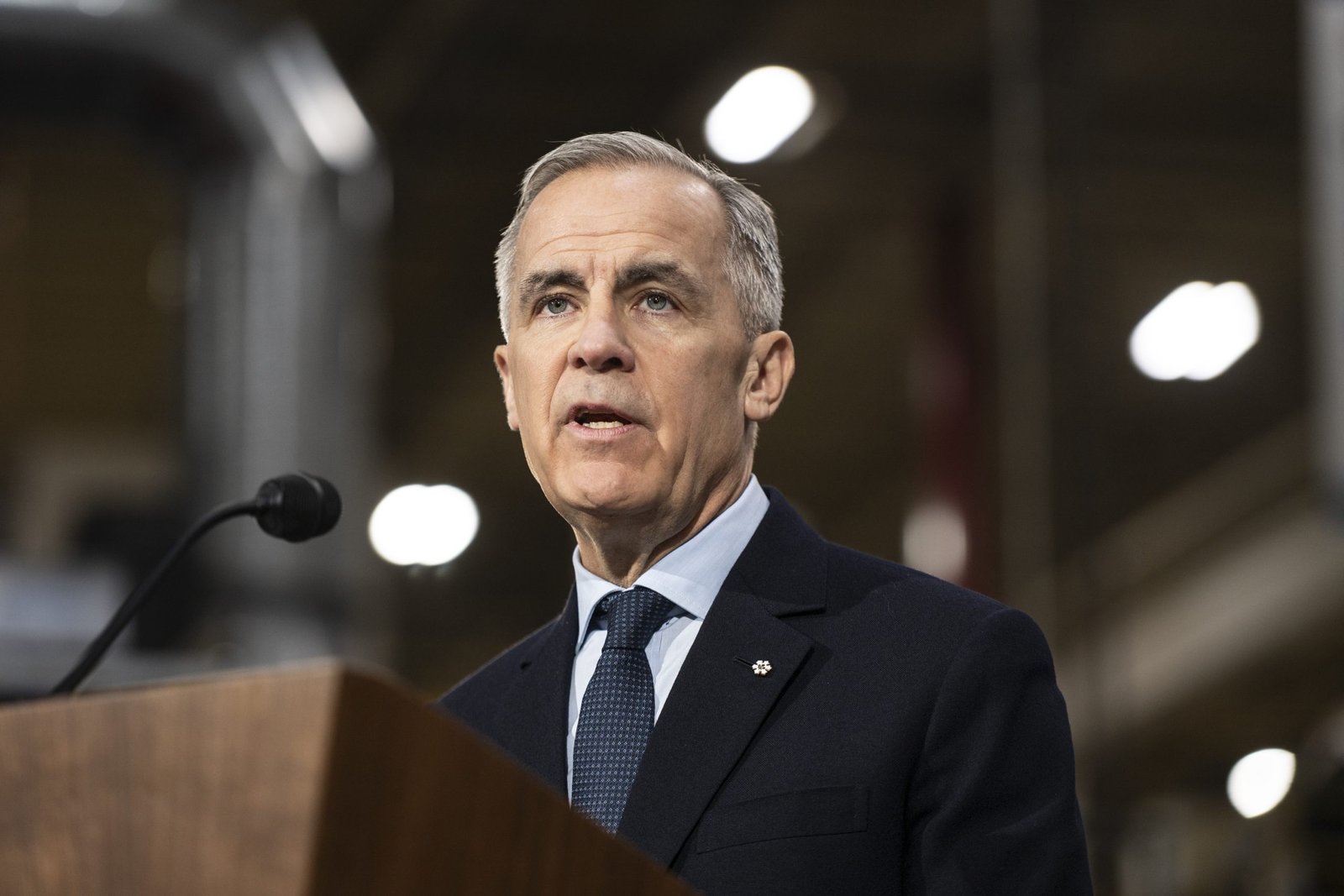

Prime Minister Mark Carney announced last month his government would increase the rebate by 25 per cent for the next five years and offer a one-time top-off equal to 50 per cent of the annual total in July.

Carney said the expanded rebate is needed because the cost of essentials has been “too high for too long” and many Canadians are feeling daily financial pressure.

He attributed the high prices to the after-effects of the pandemic on the economy, supply chain shocks caused by U.S. President Donald Trump’s global trade war and other factors, such as climate change.

The rebate was also renamed as the Canada Groceries and Essentials Benefit.

The bill to implement the tax changes passed through the House within a week after MPs unanimously backed a Conservative motion to speed up its progressing through the Chamber in a rare show of cooperation.

Conservatives offer olive branch on expanding GST rebate but prepare to fight Liberals on criminal justice bills

It was immediately sent to the Senate, which completed its review on Thursday.

The government says the rebate will help more than 12 million Canadians.

The Parliamentary Budget Officer’s preliminary cost estimate came in at $12.4 billion over the next five years.

The government says the rebate will help more than 12 million Canadians.

Eligibility is limited to those who are 19 or older, a resident of Canada and fall below an income threshold.

That amount varies based on living arrangement.

In 2024, the cut-off for a single person with no children was $56,181. For a single parent with four children, it was $74,201.

The government says the rebate will provide a family of four will receive up to $1,890 this year, and about $1,400 annually for the next four years; and a single person will receive up to $950 this year, and about $700 annually for the next four years.

Since 2020, food prices have risen faster than overall inflation, costing the average household $782. With this support, Canada’s new government will be offsetting grocery cost increases beyond overall inflation since the pandemic.

The food cost angle of the credit bears similarities to the Trudeau-era grocery benefit in 2023. It was an increase to the GST rebate but framed as a way to provide extra money to help Canadians cover the cost of inflationary increases in grocery bills.