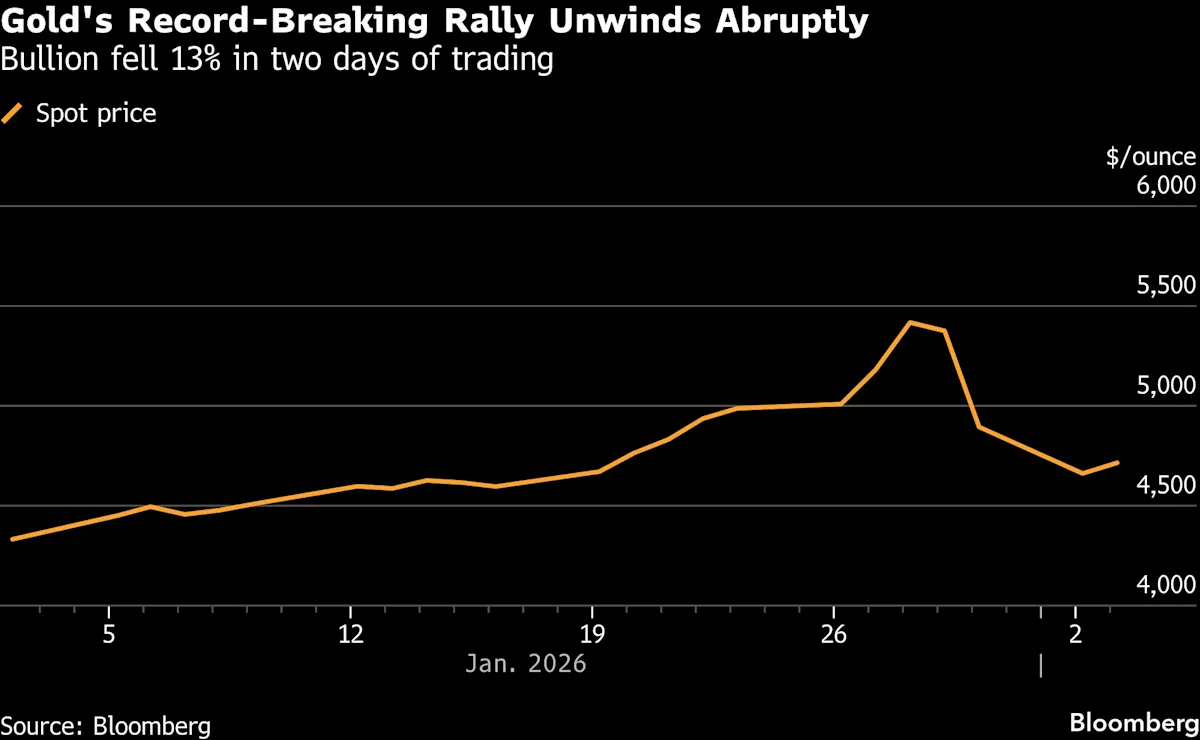

(Bloomberg) — Gold advanced along with silver, as dip-buyers crowded into precious metals following an abrupt unwinding of a record-breaking rally.

Spot gold climbed as much as 6% to near $4,940 an ounce, after falling in the previous session to extend a slump on Friday that was the steepest in more than a decade. Silver rose more than 10% — taking it back above $87 an ounce — as a risk-on tone returned to wider markets and the US dollar fell.

Most Read from Bloomberg

Precious metals had retreated from record highs in moves that followed a slew of warnings from market watchers that the advances, especially for silver, had been too large and too swift. Ahead of that, the metals’ climb had been underpinned by renewed concerns about geopolitical upheaval, currency debasement and threats to the Federal Reserve’s independence.

“The foundations supporting gold today are largely unchanged from those that prevailed prior to the correction,” said Ahmad Assiri, market strategist at Pepperstone Group Ltd., referring to geopolitical risks, expectations for easier monetary policy, and the metal’s role as a diversifier in portfolios.

“That said, volatility is likely to remain heightened in the near term as markets continue to digest the recent dislocation,” Assiri added.

Some banks backed gold to recover, with Deutsche Bank AG saying on Monday that it was standing by its forecast for bullion to rally to $6,000 an ounce.

Gold’s 14-day relative-strength index — one measure of whether an asset is seen as overbought or oversold — was at 54 on Tuesday. Last Wednesday, the reading topped 90, far above the level of 70 that can suggest gains have been too rapid and may reverse at some point.

The extent to which Chinese investors buy the dip will play a role in determining the direction of the market. Last weekend, buyers flocked to the country’s biggest bullion marketplace in Shenzhen to stock up on jewelry and bars ahead of the Lunar New Year. China’s markets will be closed for just over a week from Feb. 16 for the break. The country’s major state-owned banks, meanwhile, are tightening controls on gold investments to manage volatility.

What Bloomberg’s Strategists Say…

“Gold’s 3-day plunge was very much a correction waiting to happen, but the fundamental drivers for its multi-year advance are still in play to argue against a sustained tumble for precious metals. Given the unlikelihood of a rapid tightening cycle of monetary policy globally and lingering geopolitical concerns, a more modest grind higher for precious metals looks likely.”