American small businesses are trimming their payrolls, just as the busy holiday shopping season ramps up.

Companies with fewer than 50 employees shed 120,000 jobs in November, according to data from payroll processing giant ADP. The sharp drop comes just ahead of a month that, for many small businesses, is the most pivotal sales period of the year.

“The labor market is not weak but it is weakening, and the first to crack is small establishments,” ADP chief economist Nela Richardson said on a conference call Thursday.

She noted that high inflation, wavering consumer spending, tariffs and broader economic uncertainty have all contributed to the pressure on smaller businesses.

But the data doesn’t capture the whole story for small business owners, many of whom are agonizing over how to do right by employees they care deeply about, and still keep the lights on.

Cautious consumers

While some small businesses are actively laying off workers, as the November data showed, others are making more subtle personnel decisions, such as pausing new hiring or simply not replacing workers who leave.

“Those little changes at the margin are actually adding up,” said ADP’s Richardson.

Hanna Scholz is president of Bike Friday, a manufacturer of custom bicycles in Eugene, Oregon. She said that while she has not had to lay off any employees, her total headcount has fallen this year by three, down from 24 to 21 because some long-time employees left for health reasons.

Scholz pointed to weaker consumer demand as the primary reason behind her decision not to replace them.

Scholz says her American customers are pulling back on spending as uncertainty around the rising cost of living weighs on them.

Meanwhile, sales to her smaller — but generally more affluent — group of customers in Asia have remained strong.

“If there’s uncertainty, it’s normal human behavior to slow down big purchase decisions… And bikes are not seen as totally essential,” she said.

Consumer confidence fell sharply in November, with the Conference Board registering its lowest metric in seven months. Survey respondents cited inflation, tariffs and the government shutdown as factors contributing to their growing anxiety about their economic outlook.

For Scholz, not replacing the three workers who left has enabled her to partially offset the weaker U.S. demand.

At the very least, she said, “it slows the bleeding.”

Soaring costs

Stuart Leventhal, owner of Down to Earth Living, a decor and furniture store in Pomona New York, is also facing a drop in customer demand.

He says shoppers have been more cautious with their spending decisions recently. And while they’re still buying, they are often opting for fewer pieces or pushing their purchases into next year.

But softer consumer spending is only one of several challenges facing Leventhal’s small business.

Holding on to his beloved, long-time employees, he said, has come at a steep price: Sharply lower profits.

Leventhal estimated that he’s taken a 10% cut in profitability this year, rather than let go of any of his workers.

“We’re a good employer and we like to protect our people,” said Leventhal.

But Down to Earth Living is also facing another cost it didn’t have to worry about this time last year: Shouldering part of the added tariff costs for its largely imported inventory, rather than passing them on directly to consumers.

“We can’t take much more than we’re absorbing now,” he said.

The rising costs of importing merchandise and materials with new tariffs is taking a toll on businesses across the country, both large and small. But small businesses tend to have much less of a financial cushion to absorb them.

On the other side of the country from Leventhal’s furniture shop, Lacie Carroll-Marsh has seen the cost of imported products soar this year at her Snohomish, Washington craft candle company, Malicious Women.

The candle jars and packaging she uses are imported from Taiwan, where there is now a 20% customs tariff tacked on the their wholesacost.

The soy wax she uses is produced in the U.S., but Carroll-Marsh now pays nearly 12% more for her wax than she did last year. A distributor told her that part of the reason for this was a severe labor shortage on soy farms caused by the deportation and departure of immigrant farm workers.

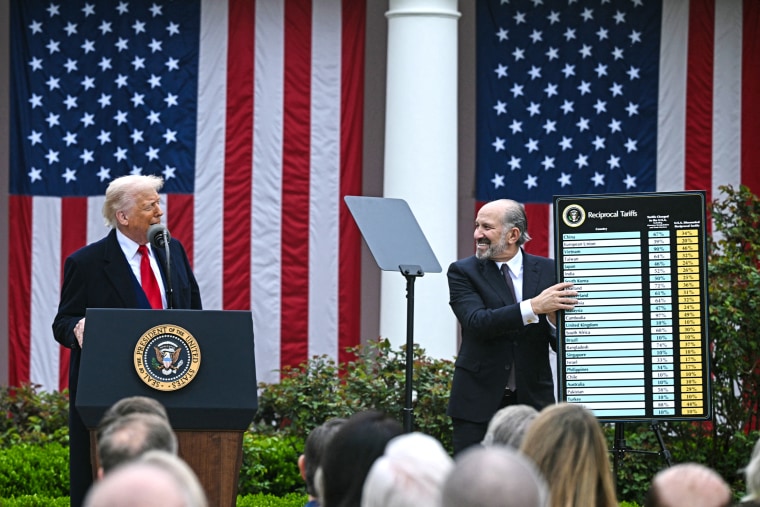

Since taking office in January, President Donald Trump has overseen an unprecedented crackdown on undocumented immigrants. He has also moved to restrict legal immigration.

More than 527,000 undocumented immigrants have been deported from the U.S. this year, according to data through October from the Department of Homeland Security. Another 1.6 million immigrants have left the United States voluntarily since January, the department estimates.

The exact number of farmworkers who have been deported or have chosen to leave the country is difficult to pin down, because many of these workers move seasonally and get paid under the table. But as of 2022, more than 40% of hired crop farmworkers were undocumented, according to the Department of Agriculture.

The toughest choices

Carroll-Marsh has owned and operated Malicious Women since 2017. But so far this year, she’s had to lay off 17 out of her 31 employees.

“Most of my employees have been with me, five, six, seven years,” she said. “I know their kids. We’ve gone camping together. We have Christmases together. And it hurts. There’s tears on both sides.”

Carroll-Marsh pays her employees an average of $24 an hour, and some make up to $30. She doesn’t want to pay them any less.

“In order to get good employees and keep good employees, we have to pay them,” she said.

In addition to hourly wages, the health insurance costs that Carroll-Marsh pays to cover her employees are going to become “completely out of reach” next year, she said.

Starting in February, her monthly contribution per employee is going to jump from $728 to $1,400.

Affordable Care Act subsidies in place since the Covid-19 pandemic are set to expire on December 31, following a prolonged government shutdown over the issue. This means health insurance premiums for millions of Americans will spike in the new year.

Unless sales dramatically recover in the coming months, Carroll-Marsh said she may have to lay off three more employees.

“We are on a skeleton crew,” she said. “Every single member of my retail team is working at the warehouse.”

Blame games

As small businesses struggle around the country, policymakers and advocacy groups in Washington are eager to blame the other side for the growing economic pain.

The Main Street Alliance, a liberal-leaning network of 30,000 small-business owners, said Trump and his fellow Republicans are responsible for the difficult conditions for small businesses.

“Trade wars, healthcare cuts, and tax breaks for big corporations have left Main Street businesses struggling to hire and grow,” Richard Trent, the group’s executive director, told NBC News.

The White House and Trump administration officials, meanwhile, say the bad news for small businesses is a temporary blip, not a long term trend.

“President Trump promised to bring prosperity back to Main Street with an America First agenda that benefits every small business, just as he did in his first term,” said White House spokeswoman Taylor Rogers. “In addition to slashing regulations and lowering energy costs, the Trump administration signed the largest Working Families Tax Cut in history to unleash unprecedented growth for small businesses with a permanent 20% small business tax deduction and full expensing of equipment investments.”

Commerce Secretary Howard Lutnick dismissed the idea that tariffs were a cause of small businesses’ shrinking payrolls.

“The democratic shutdown hurt the numbers. And then remember, as you deport people, that’s going to suppress private job numbers of small businesses,” he said in an interview Thursday on CNBC’s “Squawk on the Street.”

“I think this is just a near term event,” said Lutnick, referring to the job losses at small businesses.

“You’ll see, as the numbers come through over the next couple of months, you’ll see that all pass. And next year, the numbers are going to be fantastic,” he said.