Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

What are the biggest risks haunting the world? Back in 2010, it was fiscal and finance threats — at least according to an annual survey of participants in the World Economic Forum meeting at Davos. Then in 2020 environmental issues topped the league.

Now worries about war, of both the kinetic and economic sort, are dominating, judging from the latest WEF poll. Fiscal issues have plunged to 17th place. This is striking. However, as the Davos tribe gathers next week, investors should remember a key point: the WEF consensus is often wrong. So much so that some hedge fund types joke that the smartest trade is to do the opposite of whatever the Davos discourse implies.

So could 2026 be the year that fiscal risks finally explode in an “economic reckoning”, to cite the WEF? Should we care that global debt now sits at above 235 per cent of global GDP, and rising, at a time when markets seem calm?

It is an interesting question to ponder in the US, where the debt-to-GDP ratio has jumped above 100 per cent and President Donald Trump is bullying the Federal Reserve into lowering rates to reduce debt-servicing costs. So, too, in the UK, given its weak growth and rising debt.

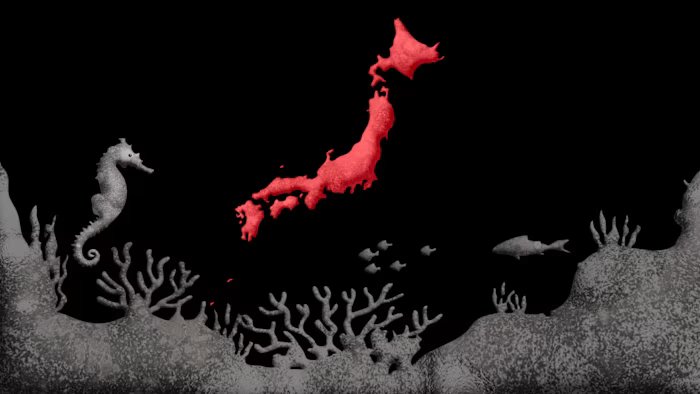

But another place that merits more debate is Japan, which (in)famously has net and gross debt-to-GDP ratios of 130 and 240 per cent respectively. Japan is currently a darling for global equity investors, because it seems relatively stable — compared with the US — and its companies crucial for global supply chains in sectors ranging from robotics to shipping.

Better still, its new(ish) leader Sanae Takaichi has promised economic reforms and enjoys a stunning 76 per cent approval, thanks in part to her refreshing style. Indeed, this week the Japanese stock market hit record highs, amid news that Takaichi will declare a snap election to consolidate her power — a move that could usher in a $135bn stimulus package and more reforms.

So far, so exciting. But this week the yen also tumbled to almost ¥160 to the dollar. That is as startling as Takaichi’s drumming. “According to both the IMF and the Organisation for Economic Co-operation and Development the purchasing power parity for yen/dollar is in the 90s,” Peter Tasker, a Japan analyst at Arcus, points out.

And while this weakness used to be blamed on Japan’s zero interest rate policy, this week 10-year yields on Japanese government bonds (or JGBs) hit 2.16 per cent, sharply higher than in recent years.

Why? Robin Brooks, former chief economist of the Institute of International Finance, thinks this signals a looming crisis. “The yen is falling because markets want to see interest rates rise, which are still at artificially low levels and don’t compensate investors enough for what they see as rising risk of default,” he argues. And while the Bank of Japan wants to end quantitative easing, that would raise servicing costs, and “risk pushing Japan into a fiscal crisis”, Brooks says. “Japan is trapped.”

Others, like Tasker, disagree. “Some people seem to enjoy apocalyptic narratives about Japanese finance,” he says, insisting that higher rates are “just another piece of evidence showing that Japan is normalising”. More specifically, as Matthew Klein of the Overshoot notes, Japan is finally seeing higher growth and prices, after years of stagnation.

This is already shrinking the deficit. And one issue that possibly makes the debt burden less threatening is that over 90 per cent of JGBs are domestically held. This means that if future haircuts occur, it might be easier for the market to swallow them than in a place like the US or Europe, since Japan retains a strong culture of shared sacrifice and patriotic duty.

However, that may not protect Japan forever. As the BoJ notes in its latest financial stability report, “foreign investors, including hedge funds, have increased transaction volume in JGB markets significantly”. Indeed, somewhat remarkably, they represent two-thirds of all cash trading, seemingly because hedgies are playing the so-called basis trade with JGBs, echoing US Treasuries.

When that basis trade was suddenly unwound in Treasuries in 2020, US bond markets melted down. And that could happen again in Japan, particularly given the prominence of the yen carry trade. In short: if a fiscal panic erupts, it could spiral fast.

Don’t get me wrong: I am not predicting that Takaichi (whom I admire) will mess up; nor that there will be an immediate crisis in US Treasuries or gilts. But the key point is this: what is happening in Japan reflects a paradox, namely that debt keeps inexorably growing but most investors seem willing to give governments the benefit of the doubt, never mind that we have no idea how this can ever be resolved. This complacency looks likely to continue in 2026. However, the risk of a so-called Wile E Coyote moment in which investors suddenly look down and panic cannot be removed by silence alone.

Remember: back in 2018, as I noted at the time, the Davos tribe was utterly uninterested in talking about pandemic risks — until they were shocked by the subsequent Covid-19 outbreak, and wondered why they had ignored what was hidden in plain sight. Let us hope this does not play out again in the financial world; silence matters as much as noise.

gillian.tett@ft.com