Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

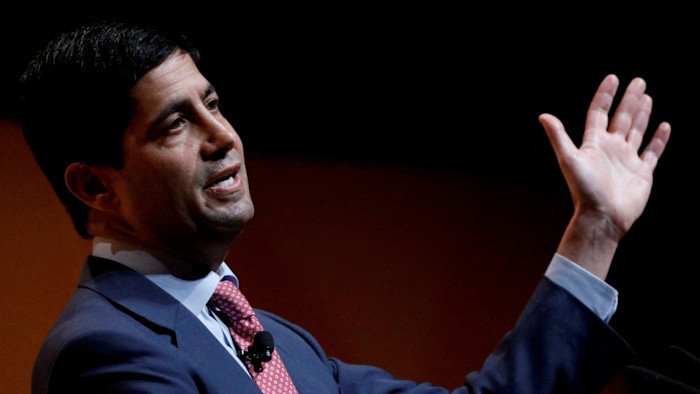

Top academics have dismissed Kevin Warsh’s claim that an AI-induced productivity boom will create room for interest rate cuts, according to a snap FT economists’ poll that highlights the challenges facing Donald Trump’s pick for Federal Reserve chair.

Warsh, who Trump named as his nominee to replace Jay Powell at the end of January, has argued that AI will trigger “the most productivity enhancing wave of our lifetimes — past, present and future”. This will expand output and pave the way for the Fed to cut US borrowing costs from their current level of 3.5-3.75 per cent without triggering a rise in prices, he says.

Almost 60 per cent of the 45 economists polled by the University of Chicago’s Clark Center for Financial Markets this week said any impact on prices and borrowing costs over the next two years was likely to be negligible — lowering PCE inflation and the neutral interest rate by less than 0.2 per cent over the next two years.

“I don’t think [the AI boom] is a disinflationary shock,” said Jonathan Wright, an economist at Johns Hopkins University and a former Fed official. “I don’t think — over the near term — it’s very inflationary either.”

Around a third of respondents said the AI boom could even force the Fed to raise the so-called neutral rate — at which borrowing costs are neither boosting or weighing on demand — slightly.

Warsh, who must be confirmed by the Senate before he can succeed Powell in mid-May, has focused on the impact of AI on productivity.

But other economists — including some at the Fed — have argued that, for now, the effects of the technology could raise demand and price pressures.

“Even if AI ultimately succeeds in greatly enhancing the productive capacity of the economy, a more immediate increase in demand associated with AI-related activity could raise inflation temporarily, absent offsetting monetary policy actions,” Fed vice-chair for monetary policy Philip Jefferson said at a Brookings Institution event on Friday, citing the impact of the boom in driving data centre construction.

Winning round the support of the rest of the rate-setting Federal Open Market Committee on the prospect of a rapid AI-induced productivity boom could prove tricky, leaving Warsh struggling to make rate cuts on the scale that Trump wants ahead of mid-term elections in November.

The FOMC’s forecasts project just one quarter-point cut this year, leaving the benchmark rate hovering above 3.25 per cent — far higher than the 1 per cent rate Trump has said the US economy needs.

Warsh’s views that the Fed should shrink a balance sheet he has labelled “bloated” could also bristle with other US rate-setters.

The FOMC recently supported a decision to end a three-year “quantitative tightening” policy, which took the size of the central bank’s stock of assets from just under $9tn to $6.6tn, amid tensions in money markets.

Investors believe shrinking the balance sheet aggressively would raise longer-term borrowing costs, likely pulling up mortgage rates and angering a White House concerned that the affordability of housing will cost them in the polls.

However, more than three-quarters of respondents to the FT-Chicago Booth poll think the Fed’s balance sheet should be less than $6tn two years from now.

“Shrinking the balance sheet somewhat further is not unreasonable if done on a conditional basis, subject to ongoing evidence that liquidity remains ample and that short-term funding markets are stable,” said Karen Dynan, a professor at Harvard University.

Around the same proportion expect Warsh will succeed in his aims, which will leave the balance sheet closer to its pre-2008 size of under $1tn.

The apparent contradiction between Warsh’s dovish stance in cutting short-term interest rates and hawkishness on the balance sheet has raised question marks about how a man who has spent much time criticising the Fed — but less on proposing solutions — will run the US central bank.

“Uncertainty abounds,” said Jane Ryngaert, of Notre Dame University. “It’s hard to say much about anything.”

Others emphasised the degree to which events could conspire for, or against, the former Fed governor’s world view.

“The AI boom may generate a booming economy, shrinking budget deficits, higher neutral interest rates and comfortable shrinkage of the Fed’s balance sheet,” said Robert Barbera, economist at Johns Hopkins University. “Or we may experience a financial market crack-up, a deep recession, a dramatic rise for deficits, eliciting a return to zero short rates, a swoon for the dollar, and demands for another big dose of [balance sheet expansion].”

Most of those polled did not support the Trump administration’s aim — which Warsh has supported — of deregulating the banking system, with just over 60 per cent saying it would have little effect on growth in the near term but materially increasing the risk of a financial crisis.