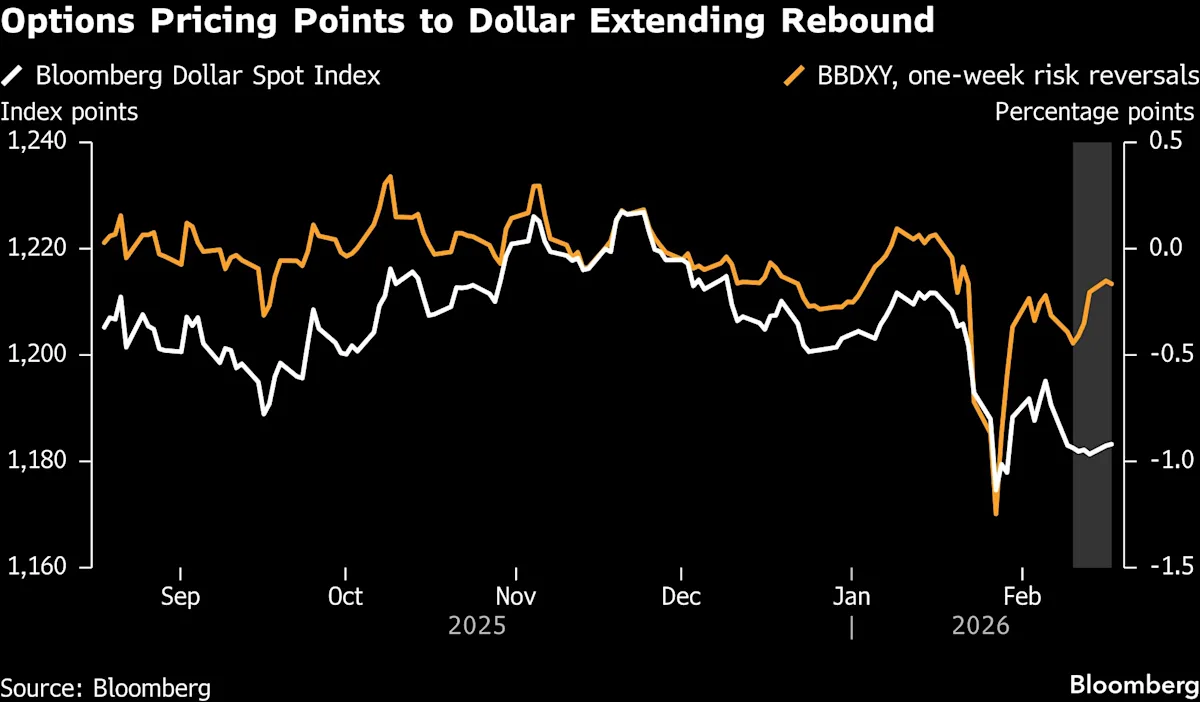

(Bloomberg) — The dollar is edging higher for a second day, shrugging off market pricing that implies roughly three Federal Reserve interest-rate cuts this year.

The Bloomberg Dollar Spot Index rose 0.1% even as the yen strengthened about 0.4%, with declines for other currencies in the basket keeping the gauge higher. Options markets indicate near-term bearishness on the greenback has eased, with so-called front-end risk reversals at their least negative in almost a month.

Most Read from Bloomberg

Money markets are still pricing about 64 basis points of Fed cuts by year-end. Some strategists argue that is overdone as three cuts may be more than the data justify, leaving the market vulnerable to a dollar rebound.

“Fed funds rate-cut bets look stretched, leaving room for a near-term USD-positive repricing,” said Elias Haddad, global head of markets strategy at Brown Brothers Harriman, citing resilient growth and underlying inflation that has stalled above the Fed’s 2% target.

With US markets closed Monday and little on the calendar until the Fed minutes and Friday’s personal consumption expenditures data, investors have had room to rebalance without a clear macro catalyst.

Hedge funds were active Tuesday in trimming dollar shorts, according to FX traders familiar with the transactions who asked not to be identified because they aren’t authorized to speak publicly.

The stronger-than-expected January jobs report has weakened the case for additional “insurance cuts” in the spring, Danske Bank A/S analysts including chief FX analyst Jens Naervig Pedersen wrote. They still expect the Fed to cut in June and September, then hold rates in a 3.00%-3.25% range into 2027.

Geopolitical risks are also back in focus as another round of nuclear negotiations between the US and Iran looms, while US President Donald Trump said he’s discussing future weapons sales to Taiwan with Chinese President Xi Jinping.

Iran Meets UN Nuclear Chief Before Next Round of US Talks (2)

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.