VANCOUVER — A team of Canada Revenue Agency “cryptoasset auditors” has been mining a rich seam of unpaid taxes, working on more than 200 files and reaping more $100 million in the last three years.

While the agency says up to 40 per cent of taxpayers who use cryptoasset platforms either haven’t filed their taxes or are at high risk of non-compliance, no criminal charges have been laid since 2020.

Court filings involving a Vancouver-based crypto firm suggest the federal government’s efforts to rein in crypto-based tax evasion and illicit financing are hampered by limited resources for enforcement in a space hallmarked by its borderless anonymity.

A CRA application filed in Federal Court in September says Canada’s Minister of National Revenue is concerned about taxpayers using the anonymous underground economy to evade taxes, fuelled by cryptocurrencies and non-fungible tokens, which are digital representations of an asset.

However, the agency’s top crypto auditor says in related documents that the CRA believes “there is no way to reliably identify taxpayers operating in the crypto space and assess compliance” with income tax reporting obligations.

The CRA had gone to Federal Court to obtain an order to unmask thousands of clients of Dapper Labs Inc., a “leading company” in the space of non-fungible tokens, which also runs its own blockchain and its own line of crypto wallets for holding digital assets.

The company didn’t oppose the probe, but the documents show the CRA initially sought information on Dapper’s top 18,000 users, but negotiations with company officials and its lawyers eventually saw that number reduced to 2,500 users.

It’s only the second time a court has ordered the requirement to unmask customers of a Canadian crypto firm in a probe to smoke out possible tax evaders, known as an “unnamed persons requirement” in the Income Tax Act.

An affidavit sworn by Predrag Mizdrak, a project leader in the agency’s digital compliance and audit support division, says the cryptoasset industry is prevalent in the underground economy.

Mizdrak’s affidavit says the agency’s compliance efforts aimed at crypto platforms to date “indicate significant non-compliance in this space.”

It says previous data show approximately 15 per cent of Canadian taxpayers who use cryptoasset platforms “have not filed their taxes on time or at all.”

The agency says 30 per cent of users who do file tax returns “have been categorized as high risk for non-compliance.”

“The use of cryptoassets greatly expanded during the COVID-19 pandemic,” Mizdrak’s affidavit says.

“This has created additional compliance challenges for the CRA due to the built-in anonymity within the crypto space, the volume of transactions, and the ease of setting up accounts on many cryptoasset platforms across borders.”

The agency said in an emailed statement it has 35 auditors in its cryptoasset program, working on over 230 files and reaping “significant taxes earned by audit,” including $100 million in the past three years.

It said there had been five criminal investigations initiated with a “digital asset component” between 2020 and the first quarter of 2025, with four ongoing as of March, but no charges have been laid.

“The CRA’s criminal investigations are complex and often require years to complete,” the agency said.

“The length of time required to investigate will be dependent on the complexity, number of individuals involved, availability of evidence, international requests for assistance, and level of co-operation of witnesses with a view to determine whether criminal charges are warranted.”

Neither Dapper Labs nor its lawyers responded to requests for comment.

Companies targeted by unnamed persons requirements aren’t accused of wrongdoing, and the court will only approve them if they are about an “ascertainable” group and used by the CRA to verify tax compliance.

Canada’s anti-money laundering agency, FINTRAC, has meanwhile levied massive penalties against crypto firms this year for failing to comply with the country’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

FINTRAC announced in October it issued a record penalty of nearly $177 million against Xeltox Enterprises Ltd., which is registered as operating from a Vancouver mailbox rental business.

It also penalized Seychelles-based crypto exchange Peken Global Ltd. — operating as KuCoin — more than $19.5 million for failing to register as a foreign money services business in September.

Neither Xeltox nor Kucoin have Canadian operations or employees, but both have retained Canadian lawyers to fight the penalties in Federal Court.

Borderless but not lawless

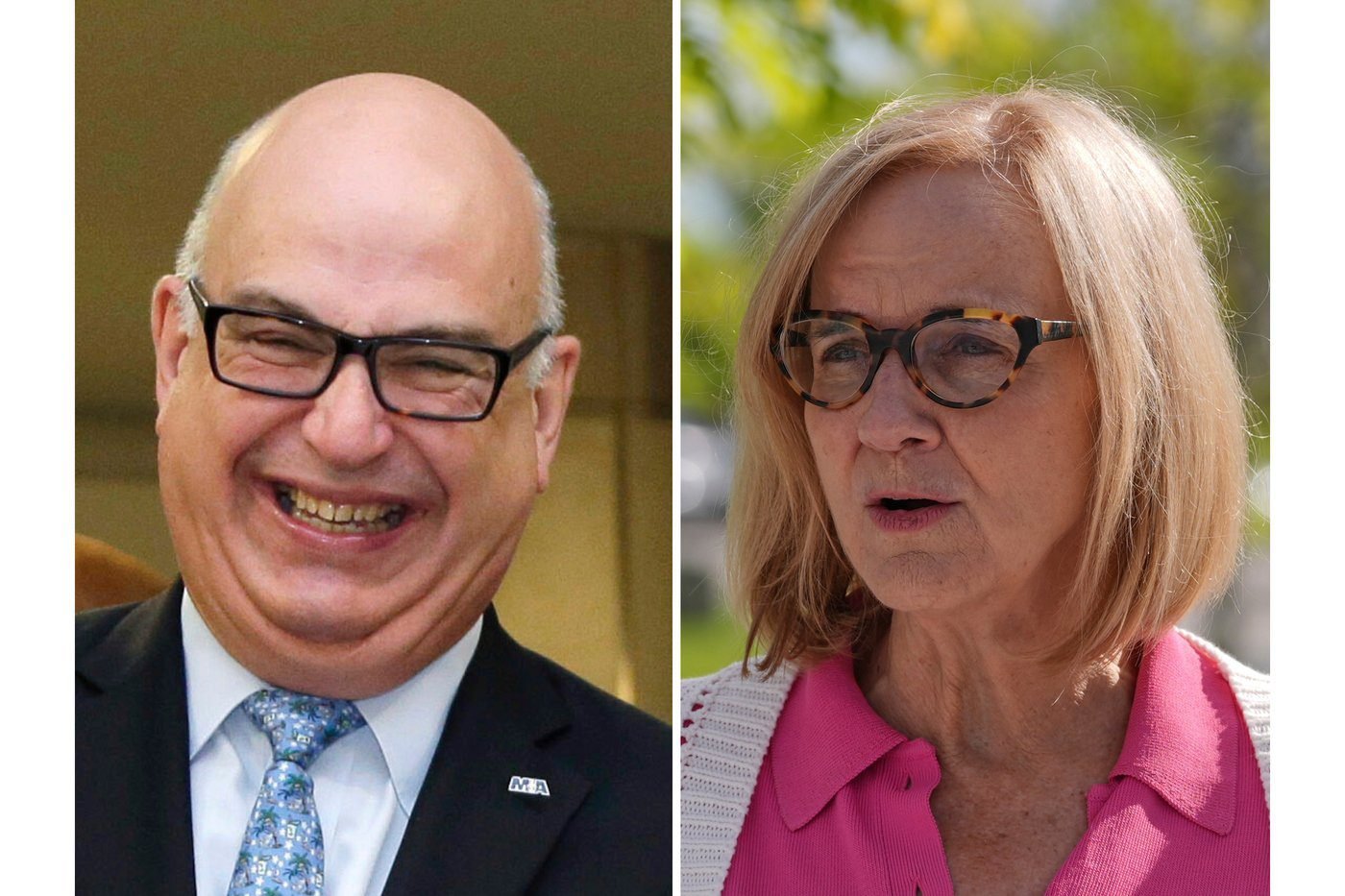

Jessica Davis, president of Insight Threat Intelligence, is an illicit financing expert who once worked for FINTRAC and the Canadian Security Intelligence Service.

She said the $100 million collected from crypto-related audits is a “pretty significant haul.”

Davis said she was surprised that there haven’t been any criminal charges yet, since crypto assets have been around for years, but it’s taken time for awareness to reach the “mainstream.”

“I think people still don’t fully understand that profits made on crypto are actually taxable, which is kind of funny,” she said. “I think that people have thought for a long time that they fall outside of that scheme, which obviously is not true.”

She said Canada is doing “really well” on the regulatory side, and though the space is borderless, it’s not “lawless.”

“Where we have more trouble is on the enforcement side of things. So, actually sustaining financial crimes investigations, actually bringing those charges and demonstrating the effectiveness of our regime.”

She said the federal and contract policing model of the RCMP means that resources for financial crime investigations can get “cannibalized to support other investigations.”

“I would argue maybe that Canadians care a lot less about financial crimes than they do about other things, rightly or wrongly. And I would also say that politically, there hasn’t been the demand on the RCMP and other enforcement bodies in Canada to actually show results on financial crimes,” she said.

This year’s budget does include a line about establishing a Canadian financial crimes agency by the spring of 2026, but Davis said details about its mandate and structure remain murky.

“It’s been in various different budgets and various iterations,” she said. “So, I think I’m a little, maybe I’ll say cautiously optimistic this time, but I’m going to wait and see what happens before spending too much energy thinking about that.”

The Federal Court granted the CRA’s unnamed persons requirement on Dapper Labs in September, nearly five years after it issued one to Toronto-based Coinsquare Ltd.

“The CRA continues to address non-compliance of taxpayers/registrants identified from this UPR; as such, we are unable to provide a final estimate on the number or value of resulting reassessments,” the agency said.

Finance Minister Francois-Philippe Champagne announced in October that the new financial crime agency would “investigate complex cases of money laundering, organized criminal activity and online financial scams.”

The agency, the Department of Finance Canada said, will be “Canada’s first-ever organization dedicated to investigating sophisticated financial crimes and recovering illicit proceeds from criminals.”

This report by The Canadian Press was first published Dec. 7, 2025.

Darryl Greer, The Canadian Press