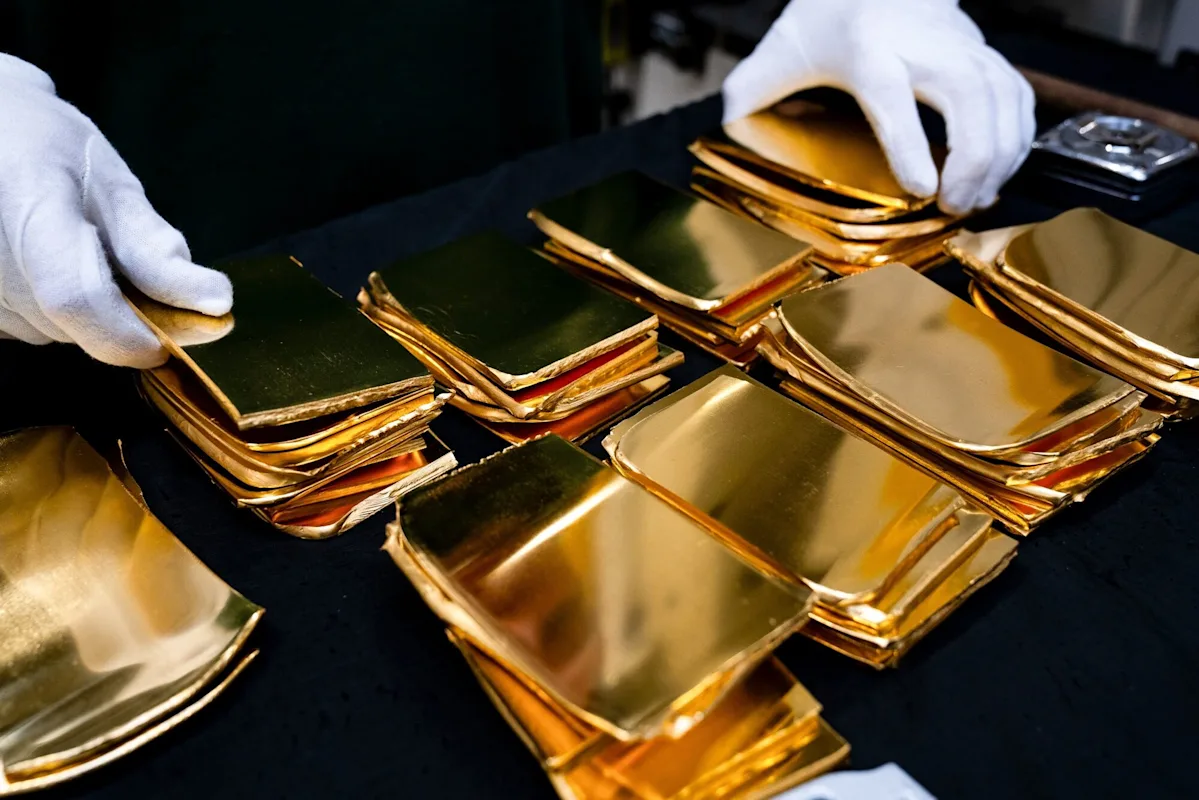

(Bloomberg) — Gold clawed back some losses after a sudden selloff in the previous session, with dip-buyers snapping up the metal ahead of key US inflation data.

Bullion rose as much as 1.4% on Friday, having lost 3.2% in the previous session – the biggest one-day fall in a week. That decline accompanied jitters on Wall Street, where prices buckled across asset classes on concern over the impact of AI on companies’ earnings. The pullback in gold may have been amplified by margin calls and algorithmic trading.

Most Read from Bloomberg

The selloff in US stocks spilled over into precious metals, as some investors with broad holdings were forced to sell commodities to cover margin calls, said Liu Shiyao, an analyst with Zijin Tianfeng Futures Co. “In many cases, investors hold these assets at the same time: when one side is sold off, the other faces redemption pressure,” she said. “However, the impact won’t be too significant. Gold is still in a consolidation phase.”

The pullback was likely intensified by selling from commodity trading advisers using computer models to bet on price moves, said Michael Ball, a macro strategist at Bloomberg.

Some of the recent selloff in gold and silver — which dropped almost 11% on Thursday — likely also stemmed from profit-taking. Precious metals had clawed back some losses after a historic rout at the turn of the month, and trading has been unusually volatile since. Despite choppy price movements, gold is set to end the week relatively flat.

Investors are now looking to US inflation figures due later Friday that may shape expectations for the Federal Reserve’s next move. Robust January jobs data published this week reduced urgency for the Fed to cut interest rates again by midyear. Lower rates are a tailwind for precious metals, which don’t pay interest.

Speaking on CNBC Wednesday, hedge fund manager David Einhorn said he expected the Fed to lower interest rates “substantially more than” markets are currently predicting. He said Kevin Warsh – whom Donald Trump has picked to succeed current Fed chair Jerome Powell – is likely to deliver the lower borrowing costs that the president wants.

Gold hit an all-time high above $5,595 an ounce on Jan. 29, the peak of a multiyear rally that began to overheat when speculative buyers piled in throughout last month. Over the two sessions that followed, bullion fell about 13%.