This article is an onsite version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and fortnightly on Saturday morning. Explore all of our newsletters here

Welcome back. How much protectionism does Europe need to bolster its competitiveness? The fact that the question is now top of the agenda shows just how radically the EU’s situation has changed, squeezed between America’s punitive tariffs and ideological antagonism and China’s rampant low-cost but increasingly high-tech competition.

The European Commission is due to unveil legislation later this month setting local content requirements for products in strategic sectors that benefit from EU or national subsidies or public procurement.

These “Buy European” rules are proving highly divisive both within the commission and among member states. They are likely to consume a lot of attention at an informal summit of EU leaders in Belgium next week — a meeting intended to inject fresh momentum into efforts to improve the bloc’s competitiveness — at the risk of detracting from other priorities such as further market integration.

I’m at ben.hall@ft.com

A good bet

The Buy European push is being spearheaded by industry commissioner Stéphane Séjourné, a Frenchman. Paris has for decades pressed the EU to level the playing field with China and the US given the protections afforded to their domestic companies. But the free-trading nations of northern Europe, led by Germany, resisted. That has changed.

As my colleagues Alice Hancock and Andy Bounds explain in this comprehensive analysis, there is wider acceptance of the need for some European preference in some areas to safeguard the EU’s place in manufacturing value chains. The argument is over the scope.

Séjourné’s early discussions included a 70 per cent local content requirement for electric vehicles purchased or leased with a public subsidy.

The FT’s Alan Beattie said he was prepared to bet a year’s lease on a BYD Dolphin (one of the carmaker’s bestselling models) that nothing like this would actually come to pass, because “70 per cent is prohibitively high and would make EU products so expensive relative to Chinese products that they would require more tariff protection”.

Details, details

No wonder European automakers, who are supposed to be the big beneficiaries, declined to join over 1,100 business leaders in signing a letter with Séjourné calling for European preference. They want to see precise details first. And the commissioner’s letter was anything but precise:

“Whether a public auction, direct state aid support or any other form of financial support, the beneficiary company will have to produce a substantial part of its output on European soil,” Séjourné wrote. “We must of course also apply this logic to foreign direct investments.”

The Buy European principle begs many questions. Which industries count as strategic? Germany for example has suggested it should include low-carbon cement and low-carbon steel, sectors that are in theory already protected by the Carbon Border Adjustment Mechanism, a levy on carbon-intensive imports.

Should content requirements target whole products or critical components? What kind of timescales and transition periods? What counts as European? What are the additional costs for business, and can Brussels avoid creating a bureaucratic monster to implement the rules?

Exception not the rule

Free trade advocates argue that European preference, if needed to sustain the EU’s capacity to innovate and add value in critical industries, should be exceptional and precisely targeted.

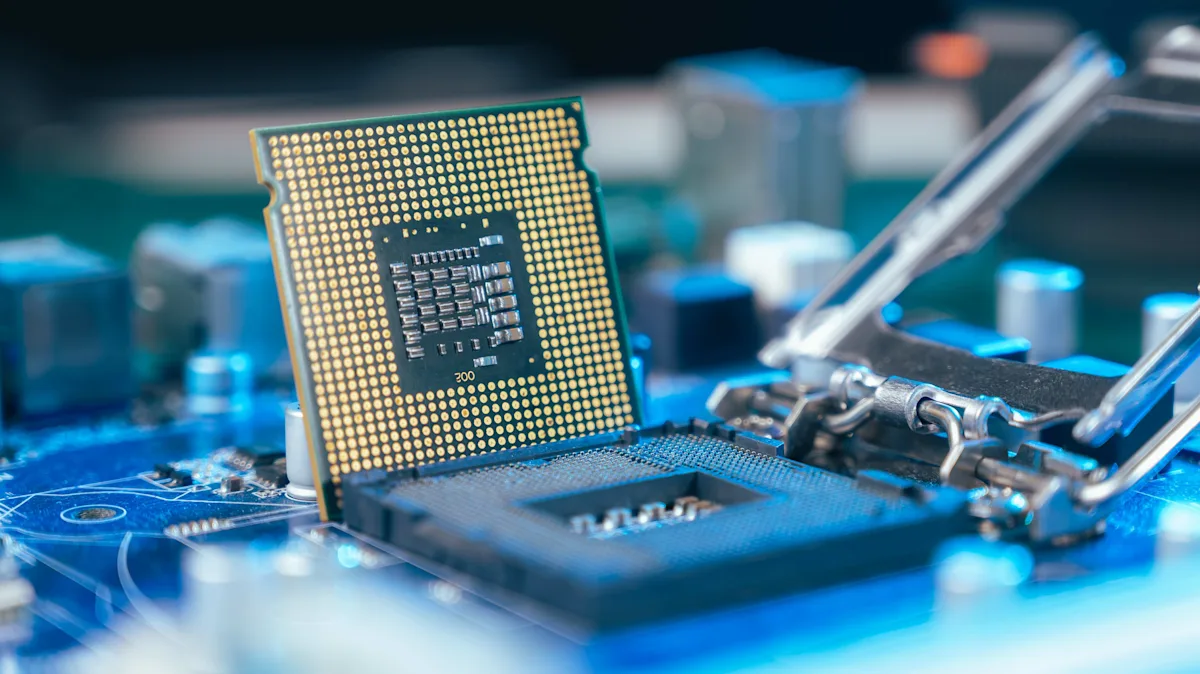

Former European Central Bank president Mario Draghi calls for “reinforced European preference principles” for defence, satellites and semiconductors in his 2024 competitiveness report. He was otherwise quite sparing.

There may also be smarter, more practical ways of achieving the same industrial objectives than blanket Buy European provisions.

As Sander Tordoir and Brad Setser pointed out in this piece, France has adopted EV subsidy rules that penalise long-distance, high-polluting transportation as well as production using electricity from coal, in effect excluding Chinese cars. The rest of the EU should follow France’s example, they said.

European preference rules for foreign direct investment, compelling technology transfer and use of local labour and supply chains, are also likely to be contentious. Proponents say new FDI requirements would prevent low-valued added Chinese-owned assembly plants in Europe from flooding markets with essentially Chinese products. But national governments are likely to see this as an EU intrusion into national sovereignty.

German revolution

Germany’s stance is likely to be key to the shape of the Buy European campaign. Berlin is a lot more open to the principle than it was before. There are many German companies among Séjourné’s co-signatories. Finance minister Lars Klingbeil, a Social Democrat, has given his backing. Insiders say this has demanded a revolution in thinking inside an orthodox finance ministry. But the Christian Democratic Union-controlled economy ministry is more cautious, insisting that European preference rules should be exceptional (although also applicable to low-carbon cement and steel).

Chancellor Friedrich Merz is also reportedly supportive of the idea of limited European preference rules. But it was not mentioned at all in a joint paper on the EU he presented with Italian prime minister Giorgia Meloni last month. For Merz, the priorities are deregulation and reducing the burdens of decarbonisation on business.

French paradox

Writing in Internationale Politik Quarterly, Andreas Rinke notes the increasingly warm relationship between the Christian Democrat Merz and radical right Meloni is an example of the German chancellor’s pragmatism towards the EU. Whereas Berlin once prioritised EU unity and the primacy of Franco-German leadership, Merz sees the value of progress through coalitions of the willing and new alliances. There is a perception in Berlin that Macron is now so weak at home that he can no longer deliver on his EU promises, Rinke says, coupled with fear that he may be succeeded by a far-right, anti-EU president next year.

In a commentary for the European Council on Foreign Relations, Giorgio Rutelli reckons the Italy-Germany relationship is now better placed to build the “cross-regional coalitions capable of breaking recurring deadlocks” than the Franco-German one.

The tussle over Buy European is emblematic of what Charles Grant describes as the “paradox of French power”. French ideas, whether on industrial policy or defence, are in the ascendant or even dominant in EU policy-making, just at the moment when France’s president and government have never seemed weaker.

Ben’s picks of the week

Sam Jones, Peggy Hollinger and Ian Bott revealed how Russia’s spy spacecraft have been intercepting crucial European satellites

Laura Pitel on how German defence giant Rheinmetall’s limitless ambitions are rattling its rivals

Recommended newsletters for you

The AI Shift — John Burn-Murdoch and Sarah O’Connor dive into how AI is transforming the world of work. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here