Article content

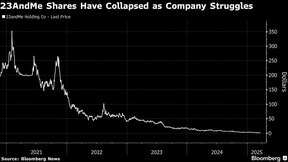

Despite collecting DNA from saliva samples from more than 15 million customers, the company hasn’t been profitable since going public in 2021. That personal information can now be sold as part of a court-supervised auction, 23andMe said in a filing.

Article content

In the years before it raised US$600 million from shareholders, the company spent heavily to draw in users with a goal of hitting 10 million customers, according to a 2021 investor presentation. But the company struggled to turn single-transaction customers into reliable — and profitable — subscribers.

“The often ‘one-time’ nature of sales involving the company’s saliva collection kits resulted in a shrinking customer base and declining topline revenues,” chief restructuring officer Matthew Kvarda said.

Today, 550,000 customers pay for the company’s two primary services, Kvarda said in a court filing. Those services produced 76 per cent of revenues during the latest fiscal year, which ended March 31, 2024.

Silicon Valley-based 23andMe will continue marketing itself to investors, aiming to get at least one binding offer by May 7, according to court papers. That deadline was set by lenders, who are seeking court permission to loan 23andMe as much as US$35 million to fund its bankruptcy.

The Chapter 11 filing in St. Louis will also resolve legal troubles related to a data breach in 2023, according to a statement. That hack compromised information about roughly seven million customers, including giving a hacker direct access to about 14,000 user accounts. The company faces about 35,000 claims related to the incident.

Article content

The company plans to continue operating throughout the sales process, it said.

The bankruptcy is the latest chapter in the saga of the DNA testing company valued at US$3.5 billion when it went public. Wojcicki’s efforts to take the struggling company private were rejected by a committee earlier this month.

23andMe has US$277.4 million in assets and US$214.7 million in liabilities, court documents show. It received a debtor-in-possession financing commitment of as much as US$35 million from JMB Capital Partners, according to the statement.

That loan must be approved by the judge overseeing the case. The debt, if approved, carries a 14 per cent interest rate and would pay a two per cent commitment fee, a six per cent exit fee and a US$100,000 work fee.

Recommended from Editorial

-

Hudson’s Bay back to court to ask for liquidation permission

-

FTX’s US$950 million bankruptcy fees among costliest

-

UBC bans Chinese AI DeepSeek from its devices and networks

“We expect the court-supervised process will advance our efforts to address the operational and financial challenges we face, including further cost reductions and the resolution of legal and leasehold liabilities,” said Mark Jensen, chair and member of the Special Committee of the Board of Directors.

Wojcicki is resigning from her role as chief executive but will continue to serve on the board, the company said in its statement. Joe Selsavage has been appointed as interim CEO.

—With assistance from Luca Casiraghi and Dorothy Ma.

Bloomberg.com

Share this article in your social network